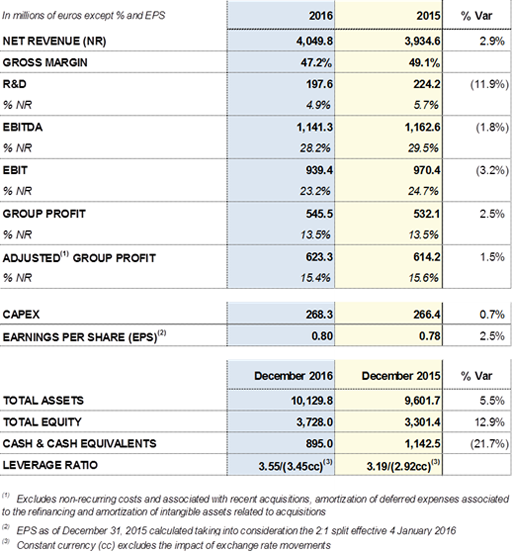

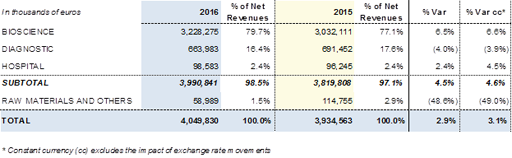

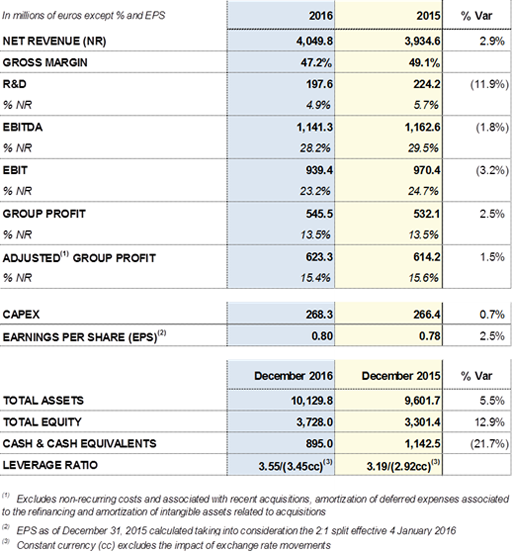

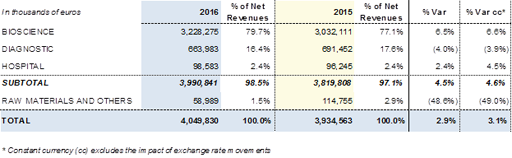

Barcelona, 28 February 2017.- Grifols (MCE: GRF, MCE: GRF.P and NASDAQ: GRFS) closed 2016 with revenues of Euros 4,049.8 million. This represents an increase of +2.9% (+3.1% cc) compared with revenues of Euros 3,934.6 million in 2015. Recurring sales (excluding Raw Materials and Others) grew by +4.5% (+4.6% cc), with revenues of Euros 3,990.8 million.

The Bioscience Division, which includes the plasma proteins business, continued to be the main driver of the company's growth in 2016. The net revenues of this division totalled Euros 3,228.3 million, and its contribution to the group's total revenues increased to 79.7%. The Diagnostic Division, with revenues of Euros 664.0 million, accounted for 16.4% of total revenues, while the Hospital Division, with revenues close to Euros 100 million, contributed 2.4% of total revenues.

The Raw Materials and Others Division, currently includes the company's non-recurring revenues.

EBITDA was Euros 1,141.3 million, decreasing -1.8% compared with the previous year. The EBITDA margin was 28.2% of revenues. EBIT fell by -3.2% to Euros 939.4 million, representing 23.2% of revenues.

Throughout 2016, margins were affected by the significant decrease in royalties relating to the transfusion diagnostics unit compared with 2015. Also, by higher plasma costs associated with the opening of new donor centres, as well as the trend towards greater incentives to reward donors for their time.

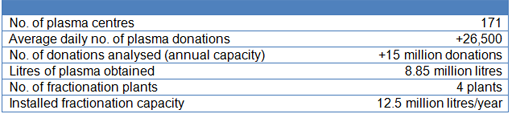

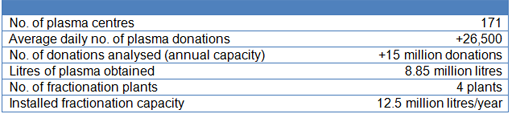

Investments for the opening of new centres continued according to the plan to reach 225 centres by 2021. At year-end, Grifols had 171 plasma donor centres in the United States, 21 more that at the beginning of 2015. In this regard, it remains a strategic priority for Grifols to ensure access to its main raw material (plasma) in order to meet the growing demand of the plasma-derived products market.

Grifols maintains the objective of maximising the use of each litre of plasma and thus optimising the profitability per litre. The company also continues with its policy of rationalising operating costs, and implementing technologies that contribute to greater efficiencies.

Grifols' net profit rose by +2.5% compared with 2015, to Euros 545.5 million. This represents 13.5% of the group's net revenues. The excellence of the financial management carried out during the year contributed decisively to the maximisation of profit.

Specifically, the financial result and that generated by Grifols' portfolio of investee companies contributed more than Euros 50 million to the results obtained in 2016 compared with the previous year. The financial expense was Euros 233.6 million, showing an improvement of 14.1%, mainly due to the termination of the interest rate derivatives and the positive impact of exchange rate variations. Grifols' effective tax rate was 23.6%.

At December 2016, Grifols' net financial debt was Euros 4,047.1 million, including Euros 895.0 million in cash. The company has more than Euros 480 million of undrawn credit facilities. At 31 December 2016, the liquidity position was over Euros 1,375 million, taking the above-mentioned undrawn credit lines into account.

The net debt to EBITDA ratio was 3.55x at December 2016, although this falls to 3.45x when the effects of exchange rate variations are excluded, compared with 3.19x reported in December 2015.

The management of the indebtedness is a priority for the company. To achieve this goal, Grifols maintains high and sustainable levels of operating activity and strong cash generation, which reaches Euros 553.3 million.

The group's cash position was Euros 895.0 million, after dividend payments of Euros 216.2 million, payments related to the acquisition of equity stakes in different companies for a total of Euros 202.7 million, payments relating to capital investments (CAPEX) totalling Euros 268.3 million, R&D (Euros 219.9 million), and debt service payments. Additionally, the company has over Euros 480 million of undrawn credit facilities.

The solid results and positive cash flow performance strengthened the balance sheet in 2016. At December 2016, total consolidated assets were Euros 10,129.8 million, a significant increase compared with Euros 9,601.7 million at December 2015.

The changes relate mainly to capital investments (CAPEX) of Euros 268.3 million; the acquisition of minority stakes in IBBI (Interstate Blood Bank, Inc.) and Singulex; the increase in Grifols' stake in Progenika Biopharma; and the higher plasma inventory level as a result of the opening of plasma centres and increased activity.

Optimisation of working capital management continued to act as a lever for improving the financial strength of the company. Inventory turnover was 281 days at December 2016 due to the investments made in the opening of new plasma donor centres. In 2016, Grifols had 171 plasma centres compared with 150 centres at the beginning of 2015. Additionally, a low average collection period was maintained, validating the measures taken. Specifically, it was 37 days, in line with that reported in December 2015. The average payment period increased from 53 days to 61 days.

Net equity rose to Euros 3,728.0 million, mainly due to profits earned during the period. Two dividend payments totalling Euros 216.2 million were made in 2016.

On 4 January 2016, a share split became effective. At 31 December 2016, Grifols' share capital was represented by 426,129,798 ordinary shares (Class A) with a par value of EUR 0.25 per share, and 261,425,110 non-voting shares (Class B) with a par value of EUR 0.05 per share.

Key Financial Metrics 2016

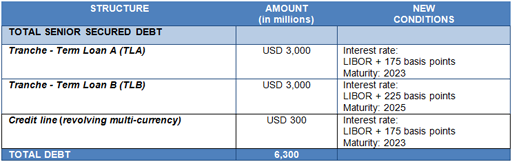

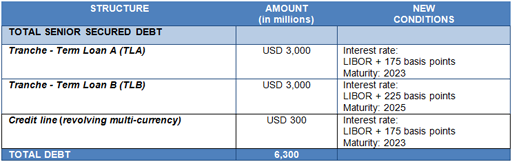

Grifols concludes its debt refinancing process substantially improving all conditions

Grifols refinanced part of its debt after the close of the 2016. The total amount of debt involved in this process was USD 6,300 million, including tranche A, tranche B, the undrawn credit facility and the USD 1,700 million term loan for financing part of the acquisition of Hologic's donor screening unit.

The completion of the refinancing process allows Grifols to improve the financial structure and the average cost of its debt.

Grifols' financial structure and new conditions after the completion of the refinancing process:

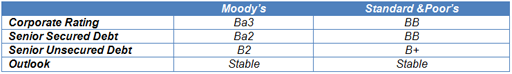

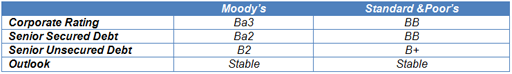

After the acquisition of Hologic's share in the donor screening unit, the credit ratings assigned by Standard & Poor's remained unchanged. Moody's revised its credit ratings by one notch, while it maintains a "Stable" outlook for the company.

The completion of the refinancing process did not result in any changes, and both rating agencies affirmed their credit ratings. Current credit ratings:

PERFORMANCE BY DIVISION: SOLID FOUNDATION FOR GROWTH

Bioscience Division: 79.7% of Grifols' revenues

Revenues of the Division totalled Euros 3,228.3 million, with an increase of +6.5% (+6.6% cc). This reflects both the trend seen in the sector and Grifols' robust leadership position.

The significant increase in sales volumes continues to be the main growth driver, although there is also a positive price impact. The geographic mix also had a positive impact on revenues in 2016.

The volume of sales of immunoglobulin (IVIG) remained solid throughout the year, with growth in all the regions where Grifols is present. The company maintained the global leadership of its IVIG. Demand for this plasma protein continued to be very strong in the U.S. market as a result of the efforts made to promote better diagnosis and greater use for the treatment of neurological diseases such as chronic inflammatory demyelinating polyneuropathy (CIDP), a segment led by the group. There was also notable growth in Europe as well as a growing contribution to revenues from certain countries such as Australia as a result of international expansion.

Sales of albumin continued to make a remarkable contribution to the division's growth, supported by significant increases in China and the United States. There was substantial growth in Latin America, India and Indonesia as a result of the marketing efforts made to promote expansion in these areas, and gradual growth in countries such as Turkey, Thailand and Brazil.

Grifols is the leader in alpha-1 antitrypsin and actively promotes the diagnosis of deficiency in this protein (AATD) in Europe, the United States and – in an incipient manner – Latin America. The significant increase in sales of this plasma product in the United States, Germany and Canada in 2016 validate the marketing efforts made and confirm the strategy being developed in these priority markets to boost growth in demand. Improvements in the identification of patients and the diagnosis of AATD continues to be one of the strategic pillars for the growth of demand in the sector. Grifols will continue working to strengthen its geographical expansion, as shown by the regulatory approvals obtained in Australia and Turkey to begin marketing this product.

Meanwhile, sales of factor VIII rose very significantly in the United States, driven by increased preference for the natural protection benefits of Alphanate®. The company also strengthened its Alphanate®'s position as the most prescribed plasma-derived factor VIII in the United States. In addition, the results of the SIPPET2 study (Survey of Inhibitors in Plasma-Products Exposed Toddlers) are influencing the choice of treatment for previously untreated patients with severe hemophilia A. In this regard, the European Medicines Agency (EMA) has launched a review of the different FVIII concentrates.

Specialty proteins developed by Grifols in order to have a differentiated product portfolio and optimise raw material costs and production capacity remained stable throughout the year. These include, among others, specific hyperimmune immunoglobulins for the treatment of infections such as rabies and tetanus.

Having specialised teams, differentiated for each product portfolio, is an essential component in Grifols' strategy of seeking balanced growth in all plasma products, with the goal of maximising profitability per litre of plasma.

Obtaining raw material

In 2016, the volume of plasma obtained was approximately 8.8 million litres, representing an increase of +8% compared with the previous year. During the course of the year, Grifols' network of donor centres received more than 26,500 donations per day. The company continues to invest in opening new plasma donor centres in the United States to support the growing demand for plasma proteins. At 31 December, Grifols had a total of 171 centres in the United States, 21 more than at the beginning of 2015.

Key activity indicators 2016:

Diagnostic Division: 16.4% of Grifols' revenues

Sales of the Diagnostic Division totalled Euros 664.0 million in 2016, compared with Euros 691.5 million reported in 2015. The revenues of the division gradually moderated their fall over the period, closing the year at -4.0% (-3.9% cc). For comparison purposes, the revenues reported in 2015 included the impact of the contracts for systems using NAT technology (Procleix® NAT Solutions) signed with the Japanese Red Cross, as well as higher revenues deriving from the old contract with Abbott for the production of antigens. This contract, signed in July 2015 for a total value of approximately USD 700 million, included new conditions and extended the supply of antigens until 2026.

Grifols is a global leader in transfusion diagnostics, with activities in various areas of specialisation:

- Revenues from sales of laboratory systems using NAT technology (Procleix® NAT Solutions) for virological screening of blood and plasma donations remained stable in the main markets, including the United States, where Grifols has a 79% of market share. The expansion of this technology in Asia (especially in China) and the Middle East is positive, as shown by the agreements signed with the Malaysian national blood bank and the Saudi Arabian Ministry of Health, among others.

In the second half of the year, there was a positive impact from the Zika virus blood screening test. This was developed jointly with Hologic to tackle the Zika virus outbreak occurred in 2016. In June, the Food and Drug Administration (FDA) approved the test for use in the United States under and Investigational New Drug (IND) research protocol. From October onwards, the North American health authorities' plan of action to combat this virus, included the obligation to perform a screening test on all blood donations made in the country. In December 2016, Grifols obtained European Conformity (CE Marking) for its Zika virus screening test.

After the close of the year, Grifols completed the acquisition of Hologic's share in this business area in order to enhance its vertical integration and further promote the development of new tests and screening routines for emerging viruses.

- The blood typing line has continued to be one of the division's growth drivers. Sales of analysers (Wadiana® and Erytra®) maintained their upward trend, and a new autoanalyser (Erytra® Eflexis®) was developed in order to offer differentiated products in mature markets such as Europe. The launch in the main countries of the European Union is planned for 2017.

Sales of gel reagents (DG-Gel® cards) for blood typing were very strong in the United States, a key country that confirmed the marketing efforts made, and in China, which has significant growth potential. There was a continuing positive trend in other countries such as South Africa, Turkey, Argentina and Brazil. Geographical expansion continues to be one of the main growth drivers.

- Sales of antigens used to manufacture diagnostic immunoassays continue to be impacted by the major cost-reduction initiative currently being led by Grifols within the framework of the joint-business agreement with Ortho Clinical Diagnostics, as well as by lower revenues obtained in 2016 under the old contract with Abbott, which entered into force in July 2015.

In the area of specialty diagnostics, the company continues to work on increasing its clinical diagnostics portfolio and developing new diagnostic tests for personalised medicine through Progenika.

Hospital Division: 2.4% of Grifols' revenues

The Hospital Division generated sales of Euros 98.6 million, a rise of +2.4% (+4.5% cc) compared with Euros 96.2 million in 2015. The recovery in revenues seen in the third quarter is confirmed in the last three months of the year, and underpins the growth of the division as it increases its internationalisation. There was notable progressive expansion in the United States, Portugal and certain countries of Latin America.

The appointment of a new commercial president of the division and the greater internationalisation that is being pursued as the main growth strategy, will contribute to a strengthening of revenues in the coming years.

By product line, the Intravenous Solutions line and the Pharmatech line, which includes intravenous therapy devices (i.v. Tools) and Hospital Logistics, were the main drivers of growth. Pharmatech sales in Spain, United States and Chile were significant. Strengthening the penetration of Pharmatech in the U.S. market represents one of the main opportunities for future growth of the division. The Intravenous Solutions and Nutrition lines showed a positive trend, while Medical Devices remained stable.

Raw Materials and Others Division: 1.5% of Grifols' revenues

Grifols' non-recurring revenues, which are included in Raw Materials and Others, totalled Euros 59.0 million, representing 1.5% of total revenues. These include, among others, contract manufacturing projects performed by Grifols Engineering, income deriving from manufacturing agreements with Kedrion, and revenues from royalties. As anticipated, the lower revenues for this division are mainly related to the reduction in royalties earned by the transfusion diagnostics unit.

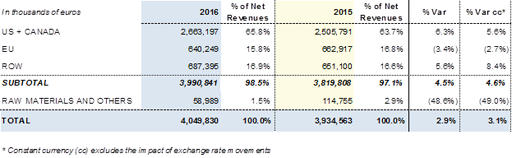

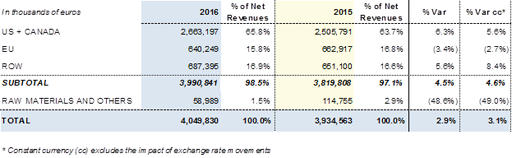

REVENUES BY REGION: GEOGRAPHICAL EXPANSION

Grifols generated more than 94% of its sales outside Spain. Geographical expansion is therefore key to promoting the organic growth of Grifols.

In the United States and Canada, revenues rose by +6.3% (+5.6% cc) to Euros 2,663.2 million, representing 65.8% of the group's total revenues. Grifols continued to invest in quality, safety and the best possible adaptation of its products to the patient's needs. In the Bioscience Division, sales of the main plasma proteins showed positive growth, confirming the commercial strategies that are being implemented. Revenues in the United States were also supported in the second half of the year by sales of diagnostic screening tests for the Zika virus in blood donations (Diagnostic Division).

Sales in the European Union totalled Euros 640.2 million, compared with Euros 662.9 million in 2015, and the division's contribution to the group's total revenues accounts for 15.8%. Countries such as Spain, Germany, Italy, United Kingdom and France continue to be the main European markets. In general terms, the company's strategy is focused on promoting better diagnosis of diseases treated with plasma proteins, as in the case of alpha-1 deficiency (AATD) in Germany, and increasing market share through the development of new products and services that provide added value for patients and healthcare professionals, as in the case of the launch of the Erytra® Eflexis® autoanalyser, among others.

Revenues generated in ROW (Rest of World) increased by +5.6% (+8.4% cc) to Euros 687.4 million, representing 16.9% of total revenues. Significant growth was seen in China and Australia, which leads the increases recorded in the Asia-Pacific region; the growth in Latin America, driven by countries such as Chile and Brazil; and the progressive penetration in Turkey and the Middle East, including Saudi Arabia and Israel.

In September 2016, Grifols opened a training centre in Dubai, which offers training programs specialising in Grifols transfusion and clinical diagnostics products, with the aim of supporting the growth of the Diagnostic Division in the Middle East.

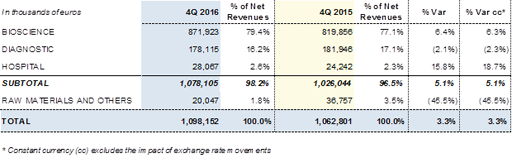

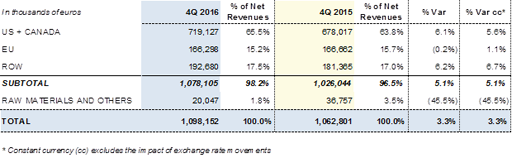

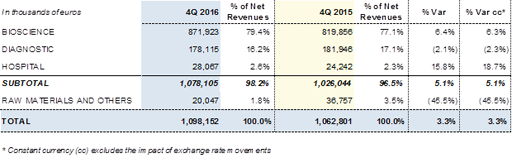

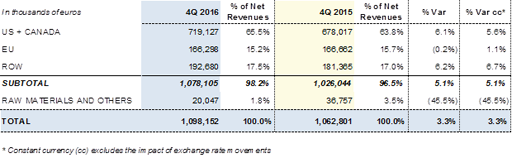

FOURTH QUARTER OF 2016

- Revenues maintain an upward trend and reach Euros 1,098 million, driven by +6.4% (+6.3% cc) sales growth of the Bioscience Division and the strength of the Hospital Division, whose sales increase by 15.8% (+18.7% cc)

In the fourth quarter of 2016, Grifols' total revenues maintained their positive trend and totalled Euros 1,098.2 million, representing an increase of +3.3%. The Bioscience Division was the main driver of growth, with revenues rising by +6.4% (+6.3% cc) to Euros 871.9 million. There was a particularly marked increase in sales of the main proteins.

Revenues of the Diagnostic Division moderate their fall in the last quarter of the year, while sales of the Hospital Division rose by +15.8% (+18.7% cc) due to the growth of the Pharmatech business lines in the United States and certain Latin American countries.

Compared with the same period of the previous year, sales in the United States and Canada grew by +6.1% (+5.6% cc) due to increased demand for plasma proteins. There was also a consolidation of the strengthening in RoW (Rest of World), which rose by +6.2% (+6.7% cc) to Euros 192.7 million. Sales in the European Union remained stable at Euros 166.3 million, with -0.2% (+1.1% cc) compared with the same period of the previous year.

Revenues by division in the fourth quarter of 2016:

Revenues by region in the fourth quarter of 2016:

INVESTING ACTIVITIES: R&D, INNOVATION, CAPEX, ACQUISITIONS

R+D+i projects

Grifols' commitment to research and development is reflected in a solid investment policy. In 2016, net investment in R&D totalled Euros 219.9 million, which represents 5.4% of total revenues for the year.

Innovation is one of the fundamental pillars for the organic growth of the group. The Grifols Innovation Office aims to evaluate and accelerate the development and marketing of innovative therapies, products and services through internal and external investment. To this end, it promotes the continuous improvement of existing products and operations in order to operate more efficiently and the identification and implementation of collaborations with various actors in the field of innovation, including academics and researchers. It also manages projects and investments in research companies in which Grifols holds a stake.

This integrated R&D+i strategy and long-term vision allowed Grifols, for the fourth year running, to be rated by Forbes magazine as one of the 100 most innovative companies in the world and, according to the "2016 Global Innovation 1000" report compiled annually by PwC, one of the thousand companies in the world that invest the most in R&D.

Key projects and initiatives in 2016:

In May 2016, the New England Journal of Medicine published the results of the SIPPET study (Survey of Inhibitors in Plasma-Products Exposed Toddlers), which show that treatment with recombinant factor VIII (rFVIII) is associated with an 87% greater incidence of inhibitors than when using plasma-derived factor VIII with von Willebrand factor (pdFVIII/VWF) in previously untreated patients with severe hemophilia A.

The United States Medical and Scientific Advisory Council (MASAC)3 has also included plasma-derived factor VIII with von Willebrand factor (VWF/pdFVIII) as a first treatment option in previously untreated children with severe hemophilia A (PUPs). In addition, the EMA (European Medicines Agency)4 announced that it will begin a review of the different FVIII concentrates in order to assess the risk of developing inhibitors in patients who are starting treatment for hemophilia A. The expectation is that the results of this study might continue to influence the choice of products for the treatment of patients with severe hemophilia A, as sustained by the principal investigators of the SIPPET study, Flora Peyvandi and Pier Mannuccio Mannucci, of the Angelo Bianchi Bonomi Hemophilia and Thrombosis Centre in Milan (Italy).

The study was sponsored by the Angelo Bianchi Bonomi Foundation, financed by the Italian Ministry of Health, and received grants from Grifols, Kedrion and LFB.

Development in record time of a blood screening test for the Zika virus. In June 2016, the FDA authorised blood screening for the Zika virus using NAT technology developed by Grifols and Hologic, for use in the United States through the agency's study protocol for investigational new drugs (IND). In August 2016, the FDA expanded its action plan by making screening test for this pathogen compulsory on all blood donations made in the country.

Subsequently, in December 2016, Grifols obtained European Conformity (CE Marking) for its Zika virus screening test.

Results of the phase I trial for the vaccine against Alzheimer's. In July 2016, Araclon Biotech presented the results obtained in the phase I clinical trial for its active immunotherapy against Alzheimer's disease. The conclusions were considered satisfactory and support the continuation of the trial, since the researchers proved that treatment with ABvac40 has a good safety and tolerability profile. Although this blind phase I study did not evaluate the efficacy of the treatment, ABvac40 produced an immune response in more than 87% of the patients who received the active principle during the trial. The company is working on phase II of the clinical trial.

Capital Investments (CAPEX)

Grifols allocated Euros 268.3 million to expand and improve production facilities of each of its three divisions. This amount is included in the new capital investment (CAPEX) plan announced for the period 2016-2020, to which the company expects to allocate a total of Euros 1,200 million with the aim of ensuring sustained growth for the company over the long term.

The planned breakdown of the investments covered allocates approximately 25% of the investments to the opening of new donation centres in the United States, as well as the expansion, renovation and relocation of existing centres. The goal is to have 225 centres in 2021. At end of the 2016, the company had 171 centres with the latest advances to streamline the donation process.

Approximately 45% of the resources will be allocated to new production facilities of the Bioscience Division, including the construction of four plants: a plasma fractionation plant and an immunoglobulin purification plant in Clayton; an albumin purification plant in Dublin (Ireland); and an alpha-1 antitrypsin purification plant in Parets del Vallès (Barcelona, Spain). These planned investments will enable Grifols to increase its production capacity in order to continue meeting the growing demand for plasma products on a sustainable basis until 2028-2030.

Approximately 12% of the investments will go to production facilities of the Diagnostic Division, including the new manufacturing plant in Emeryville for producing antigens for immunoassay reagents, which will integrate the production process and generate cost savings. These funds will also be used for the new plant in Curitiba (Brazil) for the manufacture of blood extraction and storage bags, as well as the new facilities in Parets del Vallès for the production of gel technology instruments and reagents.

Investments for improving and expanding the production facilities of the Hospital Division will account for approximately 3% of the total. 15% of the planned capital expenditure will be used to expand and improve commercial and corporate offices.

Capital investments (CAPEX) in 2016 included the following:

Investments for the opening of new plasma centres in the United States: Grifols continued with the expansion, renovation, relocation and opening of new plasma donor centres. It maintains the target of increasing its network to a total of around 225 centres in 2021, and at the end of 2016 it had 171 centres. Grifols' plasmapheresis centres in the United States have the latest advances to make donations more efficient and reinforce safety.

More capacity for protein fractionation and purification in the Bioscience Division: The main projects relate to the new IVIG purification and filling plant (Gamunex®) in Los Angeles (California, United States), with capacity for three million litres, after obtaining the FDA licence, and the construction of the new alpha-1 antitrypsin purification, dosing and sterile filling plant (Prolastin®) in the Parets del Vallès complex.

Significant progress in the construction of the Emeryville and Brazil plants in the Diagnostic Division: Most of the resources were invested in the construction of the new Emeryville plant, which will make it possible to modernise and increase antigen production. The funds were also used to complete the plant in Curitiba (Brazil) for producing blood component extraction and storage bags. Validation and commissioning works will begin during 2017. Once operational, this plant will allow Grifols to increase its production capacity and strengthen its direct commercial presence in Latin America.

In line with the aim of increasing production capacity, mainly for DG Gel® cards, new production and dosing rooms were fitted out in the Parets del Vallès facilities.

More capacity for the production of Intravenous Solutions in the Hospital Division: Capital investments of the Hospital Division are in line with the growth strategy for this area of business. They are focused mainly on increasing capacity and productivity in the manufacture of intravenous solutions in order to meet the expected growth in other markets. Grifols has production facilities in Parets del Vallès and in Las Torres de Cotillas (Murcia, Spain).

Corporate and commercial capital investments: Corporate investments included the new offices in Germany, which allowed this subsidiary to move to a new building in Frankfurt with more than 5,400 m2; the refurbishing of the offices in the Clayton site; and resources related to the start of the activity of the logistics centre in Dublin, after obtaining the approval of the Irish health authorities. A plot of land with a surface area of 48,716 m2 was also acquired in a future industrial estate close to the Parets del Vallès site.

Acquisitions

Agreement for the acquisition of Hologic's share in NAT transfusion diagnostics unit

On 14 December 2016, Grifols signed an agreement to acquire Hologic's share in the NAT (Nucleic Acid Testing) screening unit for a total of USD 1,850 million. The agreement includes activities relating to research, development and production of reagents and instruments based on NAT technology, which make it possible to detect the presence of infectious agents in blood and plasma donations, contributing to greater safety in transfusion diagnostics.

On the basis of the existing agreement with Hologic, Grifols had already been marketing the above-mentioned reagents and instruments worldwide. The assets acquired include the production plant in San Diego, development rights, patent licences and access to product manufacturers.

This operation is consistent with the consolidation and growth strategy adopted for the Diagnostic Division, and allows Grifols to continue strengthening its leadership position in the transfusion medicine segment. In addition, it will have a very positive impact on cash flow generation and on the group's margins.

Grifols financed the acquisition with a loan of USD 1,700 million and existing cash in the company's balance sheet. The transaction was made effective on 31 January 2017.

Financial investment: acquisition of a minority stake (49%) in Interstate Blood Bank Inc. (IBBI) for USD 100 million.

IBBI is one of the main private and independent plasma suppliers in the United States. The acquisition of this stake will enable Grifols to strengthen its existing commercial ties with this company. IBBI is one of Grifols' external suppliers of plasma for fractionation. The agreement includes an option to acquire the remaining 51% of the share capital.

Financial investment: acquisition of a minority stake (20%) in Singulex Inc.

Singulex is a private U.S. company based in Alameda (California) that has developed and patented the innovative ultrasensitive SMC™ technology (Simple Molecular Counting), with wide applications in clinical diagnosis and the research field. Specifically, this technology makes possible to detect biomarkers for diseases that are difficult to detect by enabling the identification of various proteins used as clinical markers, with a high degree of reliability and precision.

The agreement reached also includes exclusive worldwide licensing of the SMC™ technology developed by Singulex for use in the manufacture and marketing of immunoassays, instruments, software and other products.

Increase of the stake in Progenika Biopharma to 89.25%

Grifols exercised the option to acquire 32.93% of Progenika's shares for a total of Euros 25 million. Following this operation, Grifols' stake in Progenika increased to 89.25% of the share capital.

Progenika specialises in the design and production of genomic and proteomic tests for in vitro diagnostics, disease prognosis, response prediction and drug therapy monitoring. It is also a pioneer in the development of molecular diagnostic technologies.

Acquisition of a minority stake (49%) in Access Biologicals for USD 51 million

After the close of the 2016, Grifols made a financial investment in Access Biologicals, a leading company in the manufacture of biological products, such as specific sera and plasma reagents, which are used by biotechnology and biopharmaceutical companies for in-vitro diagnosis, cell culture, and research and development in the diagnostic field. The agreement includes an option to acquire the remaining 51% of the share capital within five years. In addition, as part of the acquisition of a stake in the company, Grifols signed a supply contract with Access Biologicals to sell Grifols biological products for non-human use.

Revenues from this contract will be part of the Raw Materials division that will change its name to Bio Supplies from January 2017.

Acquisition of six plasma centres from Kedrion

On 27 December 2016, Grifols reached an agreement for the acquisition of six plasma centres from Kedplasma, LLC, for an amount of USD 47 million. Delivery of these centres has been made in February 2017.

CORPORATE MILESTONES IN 2016

Grifols has completed the scheduled succession plan in an orderly and transparent manner

In accordance with the succession plan unanimously approved by Grifols' Board of Directors on 10 December 2015, at the end of 2016 Víctor Grífols Roura submitted his resignation as Chief Executive Officer with effect from 1 January 2017. At the same time, Raimon Grífols Roura and Víctor Grífols Deu were appointed as new joint CEOs.

This represents the implementation of the scheduled generational handover, which reiterates the founding shareholders' commitment to the company and reinforces the continuity of the values and pioneering spirit that form the foundation of Grifols' leadership.

Víctor Grífols Roura remains as non-executive Chairman of the Grifols' Board of Directors.

FULL COMMITMENT IN HUMAN RESOURCES

Grifols closed 2016 with a workforce of 14,877 employees, an increase of +0.9% compared with the previous year. There was a notable increase in the workforce in Spain, which closed the year up by +5.3% to 3,430. This represents an aggregate growth of +34.8% over the last five years. In ROW (Rest of World), the number of Grifols employees' increased by +8.3%, while remaining stable in North America. In 2016, 77% of Grifols' employees worked outside Spain. The average seniority of Grifols employees is 6.3 years and the average age is 38.7 years, while 55.5% of the workforce is under the age of 40. By gender, it is a well-balanced workforce (46% men and 54% women) which confirms again another year, equal opportunities for men and women.

The main lines of action in human resources are securing jobs and encouraging the professional and personal development of employees. Continuous training is one of the tools used to promote this development. It focuses both on technical and scientific aspects relating to quality and good manufacturing standards, risk prevention, safety and the environment, and on the development of business and personal skills.

In 2016, various global and country-specific actions were carried out in the field of occupational health and safety. Highlights include improvements in safety management in projects in the execution phase; progress in ensuring a health and safety standard in all subsidiaries of the group, including those in the United States and Ireland, and performing corporate internal audits; and the launch of a four-year plan to assess psychosocial risks in Spain.

Regarding training and professional development, the performance evaluation model common to all subsidiaries was updated; the roll-out of the leadership model was completed; the procedural model was strengthened; and there was an intensification of organisational improvement interventions in the industrial, commercial and corporate areas of the company, with the incorporation of new specific programmes for concrete situations: improvement of leadership style, remediation of difficult situations, and redesign of processes and teamwork, among others.

As regards to technical and standards training, all the industrial centres of the Bioscience Division now have the Grifols Training Platform, following its introduction in Parets del Vallès and Clayton. In addition, there was a strengthening of training in Good Manufacturing Practices (GMP). In the compliance field, a course on "Anti-corruption policy" was launched, and prevention training was intensified.

Altogether, these initiatives exceeded, once again in 2016, 500,000 hours of training with an average of 35 hours per employee.

ENVIRONMENTAL MANAGEMENT

In 2016, the 2014-2016 environmental programme was completed, with an 80% achievement of targets. This programme covers all industrial plants in Spain and the United States.

The measures adopted in the programme will make it possible to save 4.1 million kWh of electricity and 10.2 million kWh of natural gas per year, reduce water consumption by 150,000 m3 per year, recover more than 9,000 tonnes of waste and reduce consumption of raw materials by 100 tonnes.

The new environmental programme for the 2017-2019 period has already been prepared. Its main objectives are:

- Reduction of electricity consumption by 8.3 million kWh over the period, in both existing and new buildings. Measures to be adopted include those relating to eco-efficiency in the fractionation and dosing buildings in the Clayton industrial complex.

- Reduction of natural gas consumption by 19.7 million kWh in facilities that are already operational. The actions that will be carried out to achieve this goal include the renewal of the cogeneration engines in the Parets del Vallès industrial complex.

- Reduction of water consumption by 265,000 m3. Fundamental to the achievement of this goal are the projects for the re-use of clean water for cooling towers and for the reduction of waste in the reverse osmosis systems in the Parets del Vallès, Clayton and Los Angeles industrial complexes.

- Recycling of 680 tonnes in the different industrial facilities.

Among the targets achieved in 2016 are the ISO 14001 certification of the Clayton plant and renewal of this certification in the Spanish facilities for the next two years. Work also continues on the process of implementing corporate procedures in the environmental field at the Emeryville plant and in the Los Angeles industrial complex, with the aim of certifying both facilities in 2018.

In June the questionnaire to participate in the Carbon Disclosure Project (CDP) 2015 was submitted. The project assesses the organisation's strategy and performance with regard to climate change. The score obtained was "Management (B)", which indicates that Grifols is taking measures to reduce atmospheric emissions in an effective manner; that it is measuring and managing their impact; and that it is implementing a policy and strategy with specific actions that reduce the negative impacts of climate change.

The financial statements corresponding to the full year results 2016 attached in a separate document are part of the financial information provided by the company. All of the documents are available on the Grifols website (www.grifols.com)

1cc: at constant currency rates.

2The SIPPET study demonstrated that treatment with recombinant factor VIII (rFVIII) is associated with an 87% greater incidence of inhibitors than when using plasma-derived factor VIII with von Willebrand factor (pdFVIII/VWF) in previously untreated patients with severe hemophilia A.

3https://www.hemophilia.org/Researchers-Healthcare-Providers/Medical-and-Scientific-Advisory-Council-MASAC/MASAC-Recommendations/MASAC-Recommendation-On-SIPPET-Survey-of-Inhibitors-in-Plasma-Product-Exposed-Toddlers

4http://www.ema.europa.eu/ema/index.jsp?curl=pages/medicines/human/referrals/Factor_VIII/human_referral_prac_000060.jsp&mid=WC0b01ac05805c516f